Russia sets global export record with massive grain shipments to North Africa

Solomon Ekanem

https://africa.businessinsider.com/loca ... e_vignette

12 June 2025

Russia has set a new global benchmark in grain exports by delivering over 10 million tons of wheat to Egypt in 2024, an unprecedented volume that underscores Moscow’s expanding influence in global food supply chains and its deepening trade ties with North Africa.

Russia sets global export record with massive wheat shipments to North Africa

• Russia has become the top wheat supplier to Egypt, exporting over 10 million tons in 2024.

• This trade achievement highlights strengthening ties between Russia and North Africa.

• Countries like Nigeria, Morocco, and Kenya have also increased their imports of Russian grain significantly.

According to Russian Ambassador to Cairo, Georgy Borisenko, Russia emerged as Egypt’s leading grain supplier in 2024, exporting more than 10 million tons of wheat, an all-time high for both countries.

the ambassador emphasized.Russia is the largest exporter https://africa.businessinsider.com/loca ... in/wep66qg of wheat to Egypt and delivered more than ten million tons there last year. This is an unprecedented figure because no other country in the world has purchased grain in such volumes, and Russia has not sold this much wheat to any other country,

The magnitude of this trade relationship is further highlighted in a report https://tass.com/economy/1971849 by Russian news agency TASS, which cited remarks made in May by Tatyana Menlikeyeva, head of the regional branch of Russia’s Federal Center for the Safety and Quality Assessment of Agricultural Products https://africa.businessinsider.com/loca ... om/xye4xt4 in Tatarstan.

Speaking at the Russia-Islamic World KazanForum, Menlikeyeva revealed that Russia exported a total of 64 million tons of grain and grain products to 40 Muslim majority countries in 2024.

Egypt, in particular, has now become the world’s largest importer of Russian wheat, marking the highest annual grain shipment ever recorded by Moscow to a single nation.

This development signals more than just strong trade figures; it reflects a strategic partnership between Cairo and Moscow, one that is likely to deepen https://africa.businessinsider.com/loca ... ge/7wkhc85 as Russia shifts focus toward markets in the Global South and as African nations seek reliable, cost effective sources of essential imports like wheat.

These gains reflect Russia’s expanding agricultural footprint across North, West, and East Africa, with grain exports becoming a key pillar of its regional influence.

Russia’s trade relations with Africa have undergone a significant transformation in recent years, particularly in 2024, as Moscow strategically deepens its economic engagement with the continent.

Among the most notable developments is the unprecedented surge in agricultural exports, especially wheat, that has made Russia not only a vital trade partner https://africa.businessinsider.com/loca ... id/217vhzf to many African states but also a dominant player in global food supply chains

At the heart of this shift is Russia’s agricultural push. In 2024, Russian agricultural exports to Africa reached over $7 billion, a 19% increase from the previous year, spanning 45 African nations.

Wheat, barley, and corn comprised the bulk of these exports, accounting for 87% of the agricultural total. This growth is not merely statistical; it has concrete geopolitical implications.

Beyond Egypt, several African countries https://africa.businessinsider.com/loca ... ar/x7jswhv have sharply increased their Russian wheat imports. By March 2025, Nigeria’s purchases rose 2.7 times, Morocco’s more than doubled, and Kenya’s grew by 35 percent.

These gains reflect Russia’s expanding agricultural footprint across North, West, and East Africa, with grain exports becoming a key pillar of its regional influence.

_______________

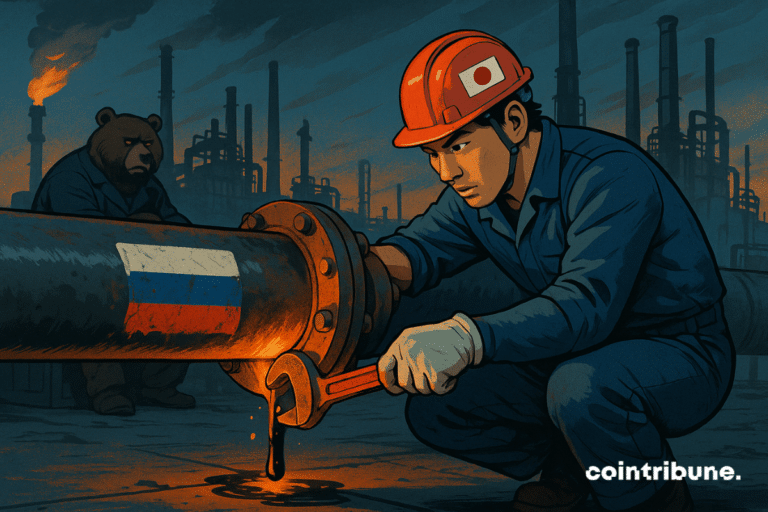

BRICS Influence Grows as Japan Restarts Russian Crude Imports

Fri 13 Jun 2025

By Luc Jose A.

https://www.cointribune.com/en/brics-ja ... crude-oil/

On June 8, 2025, a tanker under U.S. and European sanctions quietly docked in Japan, delivering Russian crude oil to a local refinery. This gesture, far from trivial, reveals a silent rift in the Western consensus on energy. While the G7 has been trying for two years to isolate Moscow, Tokyo prioritizes its energy security. This episode, both symbolic and strategic, could quietly redraw the lines of a world energy order in flux.

In Brief

• Japan imported Russian crude oil for the first time since 2022, breaking a two-year interruption due to G7 sanctions.

• The cargo was delivered on June 8, 2025 by the Voyager, a ship explicitly sanctioned by the United States and the European Union.

• This operation, though punctual, is based on Japanese exemptions related to national energy security.

• This strategic choice reflects growing tension between international political commitments and local energy realities.

The Return of Russian Crude Under Watch in Japan

While Donald Trump had mentioned 50% taxes on Russian oil, https://www.cointribune.com/en/war-in-u ... ssian-oil/ Japan imported a crude oil cargo for the first time in over two years. The delivery was made by the “Voyager”, a tanker sanctioned by both the United States and the European Union, making the operation particularly notable.

The ship docked on June 8, 2025, at a facility of Taiyo Oil, which confirmed https://asia.nikkei.com/Business/Energy ... er-2-years that it had purchased Russian crude.

It is Sakhalin Blend, a type of crude extracted in the Russian Far East, connected to the Sakhalin-1 and Sakhalin-2 energy projects. While the operation remains exceptional, it raises several concrete points:

• Japan had not imported Russian oil since 2022, when it aligned itself with the G7 sanctions following the invasion of Ukraine.

• The crude comes from a strategic region (Sakhalin Island) where Japan still holds interests in gas projects through Mitsui and Mitsubishi.

• The delivery was made by a ship explicitly sanctioned by Western powers, which could theoretically pose legal or diplomatic problems.

• The operation seems to have been made possible by specific exemptions Japan retains to guarantee its energy security, notably regarding supplies linked to Sakhalin.

These elements highlight growing tension between geopolitical commitments and energy interests, in a context where supply autonomy becomes a vital stake for Tokyo.

Between Political Alliances and Energy Realities

The delivery operation, though discreet, is already the subject of questions within diplomatic and energy circles. It takes place even as Tokyo remains officially aligned with Western sanctions.

No official reaction has been made by Japanese authorities. However, this importation is driven by the need to maintain the stability of liquefied natural gas (LNG) supply, notably in connection with the infrastructures and projects of Sakhalin.

While the cargo concerns oil, it could indirectly serve to preserve Japanese strategic interests in gas projects by avoiding offending Russia, a key country in the BRICS alliance.

This decision is not without risk for Japan’s image on the international stage. Although Western sanctions against Russia mainly aim to reduce Moscow’s energy revenues, Japan had already obtained certain exemptions to continue importing Russian LNG.

This time, it clearly concerns oil, transported by a sanctioned ship. Moreover, this could fuel diplomatic tensions, especially with Washington, Tokyo’s main strategic ally. The delivery, though punctual, could also open the way to similar initiatives by other Asian countries, thereby weakening the anti-Kremlin energy front.

In the medium term, can Japan sustainably reconcile its political commitments with its energy constraints? If other shipments follow, it might mark the beginning of a tacit easing of the bans on Russian oil in Asia, in a context where current energy revenues no longer support military spending. https://www.cointribune.com/en/russia-r ... s-looming/

For now, this operation remains an officially tolerated exception, but it reveals growing tensions between diplomatic ethics and energy reality, in a world where alliances waver in the face of economic survival imperatives.